Switzerland is one of the world’s leading countries in terms of research and development. To foster innovation and economic growth, it is crucial that this knowledge is successfully transferred to the industry. Start-up companies are an effective means to facilitate this technology transfer.

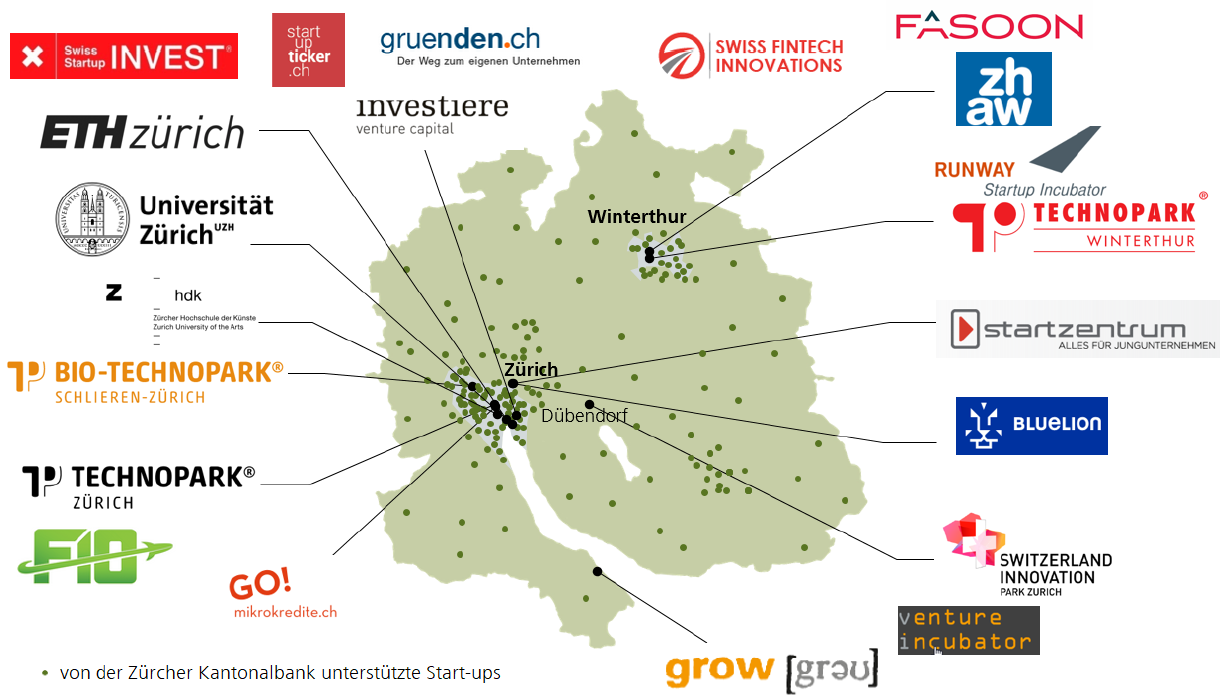

In recent years, a flourishing start-up ecosystem has developed in Switzerland with Zurich as one of the most important hotspots – especially for digital, fintech and high-tech startups.

With the ETH Zurich, the University of Zurich, the Zurich University of Applied Sciences, the Zurich University of the Arts and other universities, the academic conditions for innovative business startups in Zurich are excellent. This positive environment includes numerous other institutions such as the Technoparks in Zurich and Winterthur, the Bio-Technopark Schlieren-Zurich, the Startzentrum Zurich, CTI Invest, Venture Incubator and the planned Innovation Park in Dübendorf.

Public mandate for start-ups

As the leading bank in the economic area of Zurich, Zürcher Kantonalbank (ZKB) committed itself early to support the pioneering work of start-ups. The mandate to support innovation is derived directly from the cantonal law. The bank’s purpose is “to contribute to solving economic and social issues in the canton” and “in particular to take into account the concerns of small and medium-sized enterprises”. ZKB is involved as a partner, sponsor, founder or investor in many different fields:

Access to start-up financing

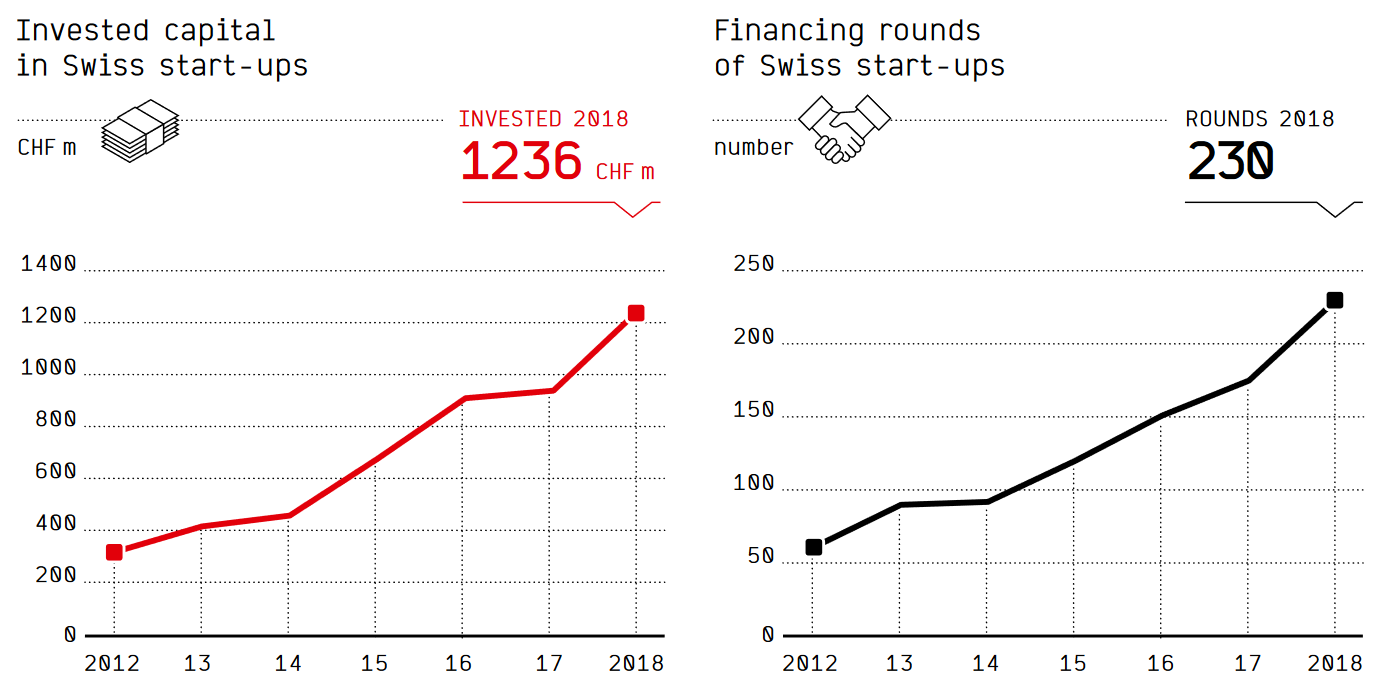

The Swiss startup ecosystem not only encourages local founders, but also attracts foreign entrepreneurs. Reasons to grow a startup in Switzerland include a high quality of life, the availability of talent and growing capital markets for start-ups. The latter can be seen in the following impressive figures:

For early stage start-ups with innovative products and services the traditional forms of financing such as a bank loan or a credit line are only available to a limited extent. Typically, liquidity is scarce and the risk of failure is high – especially before market entry, when a start-up has to invest a substantial amount of its capital into the development of a prototype or the acquisition of first customers.

In order to cover the related financing needs, Zürcher Kantonalbank launched the “pioneer” program in 2005, a sustainable initiative that specifically provides venture capital to innovative start-ups. As part of “pioneer”, ZKB has granted over CHF 125 million of risk capital financing for roughly 200 start-ups. These financing activities are associated with the creation of over 1,200 jobs in these fast-growing companies. More than 80 percent of the financing took place in the Greater Zurich Area, primarily in the form of equity capital.

About the author

Oliver Huggenberger is investment manager for start-ups at Zürcher Kantonalbank (ZKB), one of the most active early stage investors in start-ups in Switzerland. In this function, he works closely with start-ups in all financial matters and represents ZKB as shareholder and banking partner in around 30 start-up investments. Oliver holds a Master's degree in Applied Mathematics from ETH Zurich and a postgraduate degree in Finance from the University of Zurich and in Corporate Communications from the Zurich University of Applied Sciences.

Contact us

Can we put you in touch with a peer company or research institute? Do you need any information regarding your strategic expansion to Switzerland's technology and business center?

info@greaterzuricharea.com