Building on a long tradition as a leading financial hub and with top technical universities and research institutes, the Greater Zurich Area offers ideal conditions and a dedicated legal framework for driving growth and innovations in Fintech. Today, Greater Zurich is one of the leading Fintech hubs in the world, on par with Singapore and London.

Fintech in the Greater Zurich Area at a glance

- Global leading Fintech hub

- Business-friendly regulatory environment, efficient licensing processes, and rich talent pool

- Thriving Fintech ecosystem with established companies and new successful start-ups, as well as necessary framework conditions, accelerators, and research

- Historically well-established banking and insurance sector combined with technological expertise and a well-developed infrastructure

- Low market entry barriers for Fintech companies

- The world’s first regulated exchange for digital assets, thus providing the necessary framework conditions for emerging technologies to thrive

- Growing focus on sustainable finance and green Fintech

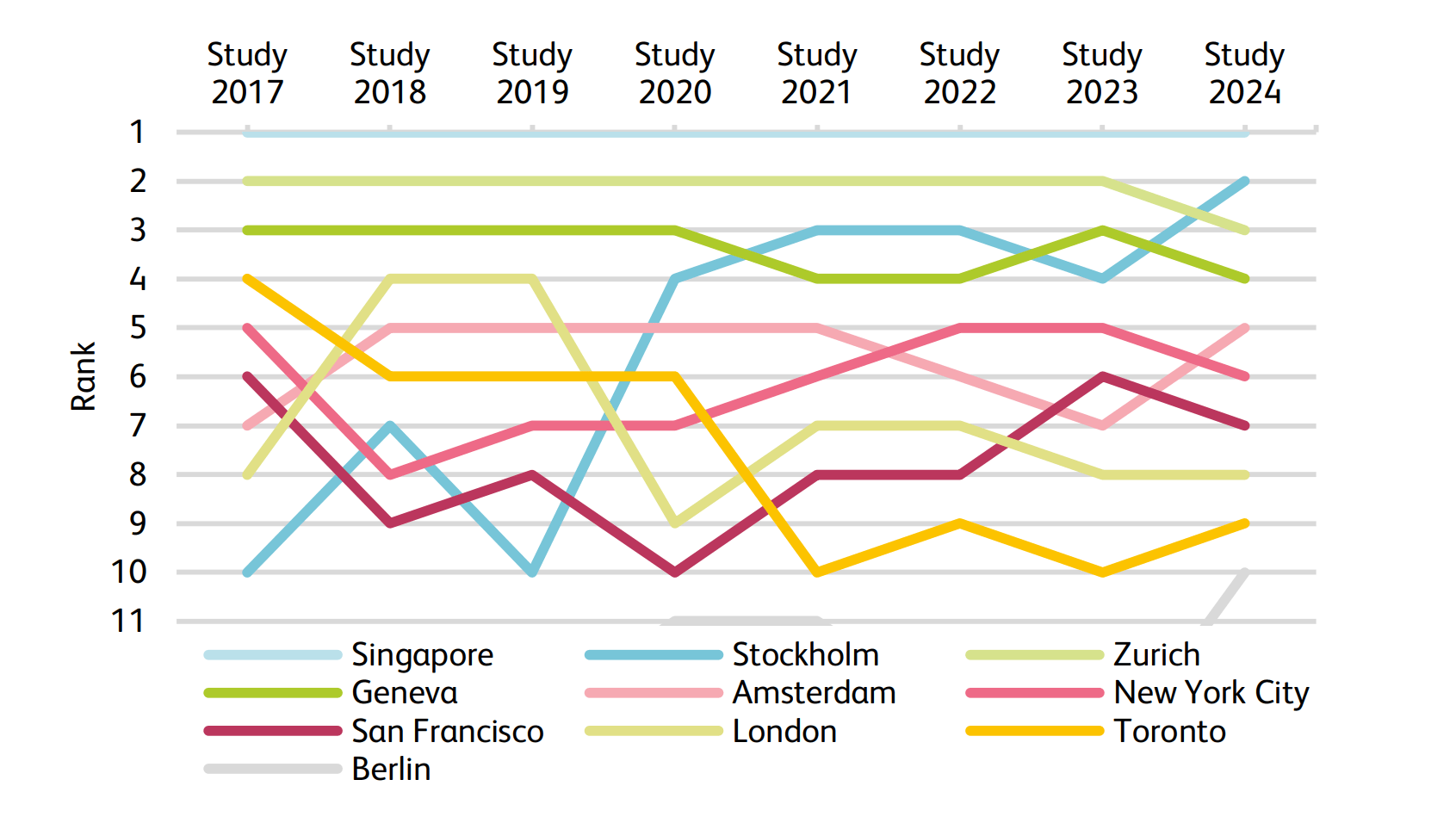

The Greater Zurich Area (GZA) is one of the leading Fintech hubs both in Europe and worldwide. According to the Global Fintech Hub Ranking 2024, Zurich continues to have the third-largest potential worldwide for entrepreneurship, innovation and financial technologies – behind Singapore and Stockholm, but ahead of London, Amsterdam, New York City, San Francisco, Hong Kong, or Toronto.

10 reasons why Fintech companies choose the Greater Zurich Area

- Internationally renowned, reliable, and innovative financial hub with global network

- Deeply rooted acceptance of Fintech among authorities

- State-of-the-art technical infrastructure

- Deep pools of capital and straightforward access to funding

- Accessibility of venture capital financing and business incubators

- Protection of property, data protection laws, and confidentiality

- Low taxes and forward-thinking regulations for financial services (sandbox, banking license light)

- World-leading educational and research institutions

- World-class engineering talent and ability to attract top talent locally and from abroad

- Supportive start-up ecosystem with world-class service providers

Greater Zurich’s innovative Fintech ecosystem with successful companies

The Zurich region is the biggest financial center in Switzerland and one of the most important financial hubs worldwide. The canton of Zurich alone is home to 15,000 offices of various banking institutions, leading research institutes, and a cluster of entrepreneurs.

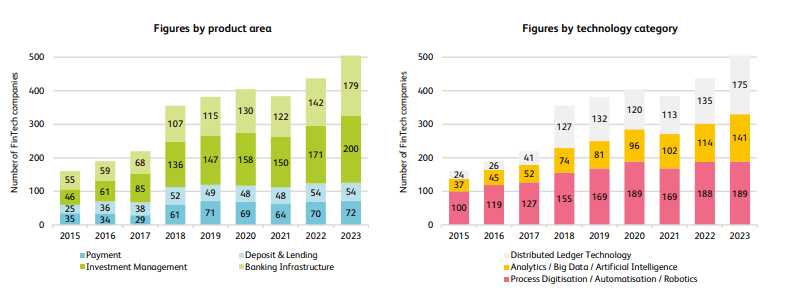

This leading role in traditional finance is also mirrored by the number of fintech enterprises in Zurich: the canton is the largest Fintech hub in Switzerland with 190 resident companies in 2023, while the neighboring canton of Zug boasts almost as many with 129 Fintech companies according to the IFZ Fintech Study 2024. Across all 11 GZA cantons and regions, the Greater Zurich Area has over two thirds of the total 483 Fintech companies in Switzerland in 2023.

Reach out to us for expert advice

Reach out to us for expert advice

Looking at investment opportunities in the Greater Zurich Area?

Do you need prompt and free access to the latest data, legal insights, and site selection? We are here to help.

Successful Fintech companies in the Greater Zurich Area

Over the years, the Greater Zurich Area has developed into a sophisticated Fintech ecosystem with numerous leading actors in academia, incubators, institutions, authorities, investors, associations and more. Discover the wide variety of Swiss Fintech companies with the interactive Swiss Fintech Map.

Static Swiss Fintech Map (PDF)

Already leading by example, the following selection of successful fintech companies shows, how the ecosystem in the Greater Zurich Area fosters fintech innovation and success in Switzerland and abroad.

Leonteq - Zurich

Leonteq - Zurich

A leading example of the prospering fintech development in the Greater Zurich region is the fintech-pioneer Leonteq. Within 10 years, the Zurich-based investment solution platform experienced tremendous growth and success and recently launched its new index for crypto assets. Based on proprietary modern technology, the company offers derivative investment products and services. Leonteq acts as both a direct issuer of its own products and as a partner to other financial institutions. The company has offices and subsidiaries in 13 countries, through which it serves over 50 markets.

Inventx - Grisons

Inventx - Grisons

Another success story with great momentum is the Grisons-based fintech company Inventx, which develops digital banking solutions for financial institutions. Inventx employs over 380 people and has recently invested over 40 million Swiss Francs in its headquarters in Chur.

Yokoy - Zurich

Yokoy - Zurich

Yokoy uses artificial intelligence to automate the entire corporate spend and corporate credit card processes. Founded in 2019 to simplify expense management, Yokoy already has over 500 customers and is expanding abroad rapidly. The start-up from Zurich has also been awarded as one of the 250 globally most promising fintech companies of 2022 by CB Insights.

Inyova - Zurich

Inyova - Zurich

Inyova is a start-up headquartered in Zurich that wants to create a more sustainable world through investing. The company offers "impact investing", allowing consumers to invest their savings into impact-focused businesses (renewable energy, diversity, healthcare). As a sustainable asset manager, Inyova handles its customer's diversified portfolios, which are designed for an attractive financial return.

Discover featured Fintech success stories

Fintech in the Greater Zurich Area: Innovative & forward-looking

Fintech material to download

This fact sheet includes data, rankings and a deep dive into Switzerland’s fintech sector.

Learn more about the benefits of doing business in the Greater Zurich Area.

This PDF provides data and information on Switzerland’s position as a blockchain hub.

Fintech & blockchain in the Greater Zurich Area

Fintech & blockchain in the Greater Zurich Area

Where world-class technology meets Swiss reliability

The Greater Zurich Area has evolved into a global Fintech and blockchain hub, thanks to factors like access to talent, leading research institutes, innovation-friendly regulators, investors and industry partners.

Contacts - Reach out