Europe represents the second-largest market in the world for pharmaceuticals. Therefore, it is highly attractive to companies with products that offer a compelling and differentiated value proposition. However, expanding to Europe can be daunting due to Europe’s multiple geographies and languages, different regulatory needs, as well as multiple EU payer requirements and reference pricing systems. Industry veteran Michelle Lock shares key insights on the strategic expansion process.

Some of the critical questions when expanding to Europe are:

1. Go alone or not?

Maintain control over commercialization in mayor markets

2. Can the product succeed in Europe/internationally?

Regulatory, pricing, and commercial model

3. Can the organization empower ex-US decision-making?

Enable appropriate local decision making and flexibility

Guiding principles for successful international builds

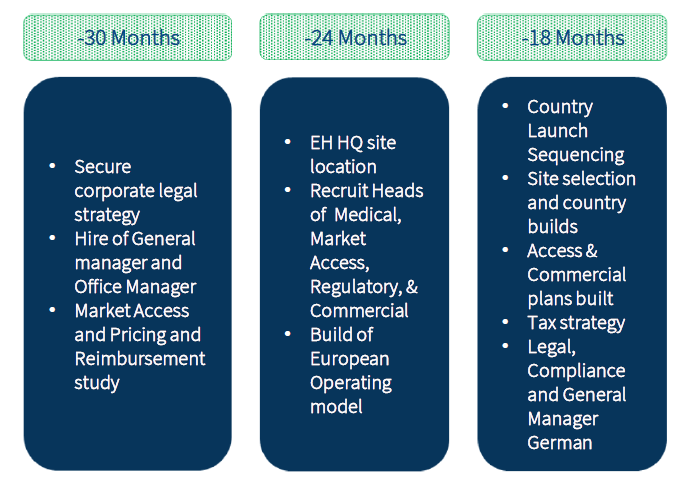

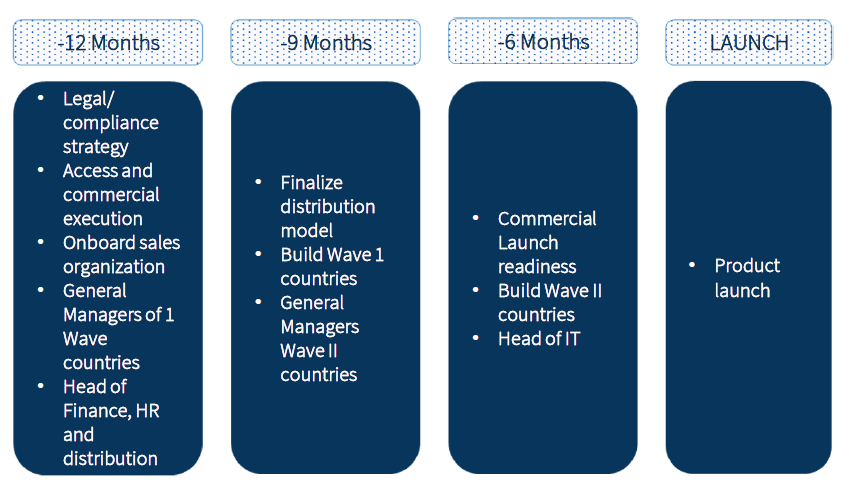

Build early:

- International build to commence 2-3yrs pre-launch

- Clarify Global/Regional/Local

Invest for success:

- Invest early to avoid under-resourcing and potential slow uptake

- Build with efficient, effective infrastructure

Calibrate & pulse build-out

- Recruit in “gated” waves; 1st wave based on opportunity and pricing

- Sequence country launches and define market-specific strategies

- Engage payers early

Over-invest in talent

- Invest early, prioritize experience and mindset

- Empower hiring decisions and provide autonomy to make decisions

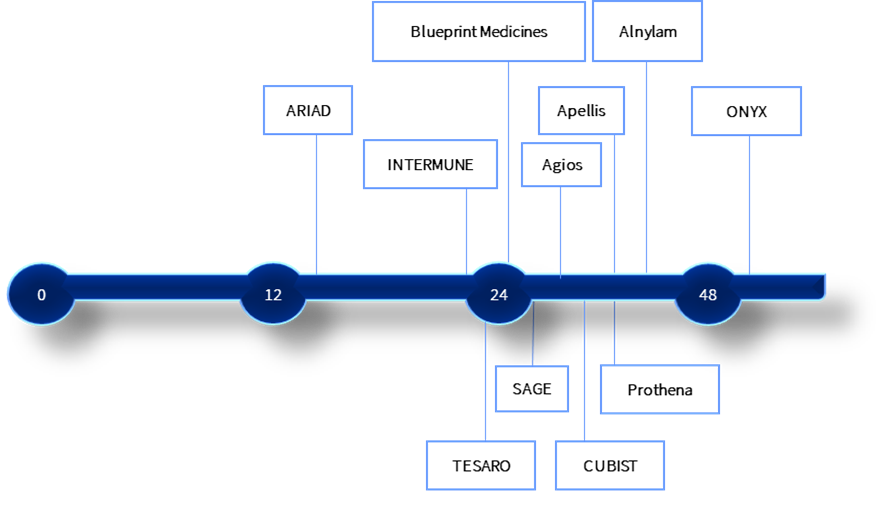

Timing & clarity are important

The EU general manager (GM) role is a critical position and should be the first hire (24-30 months pre-approval). The sequencing of hiring is important as mistakes can be costly and time-consuming. Roles to be appointed 18-24 months pre-approval include: Market Access, Medical Affairs, Regulatory and Commercial (MMRC) leadership. Allow ample time for recruitment as EU has significantly longer onboarding times than the US. Clarity should be built early for each leadership team member’s line function and leadership team accountabilities and communicated transparently. Align early on what decisions will be made from corporate HQ then empower EU leadership team to successfully run Europe.

First hire: months pre-approval (selected companies in the Greater Zurich Area)

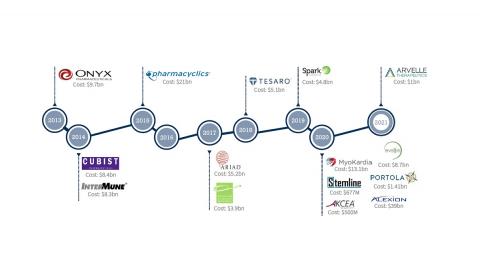

Insights provided in June 2020 by Paul Beresford (Blueprint Medicines), Oliver Schiltz (Heidrick & Struggles), Orlando Oliveira (Agios), Theresa Heggie (Alnylam), Thomas Lackner (Apellis and Prothena), Mark Altmeyer (Arvelle).

Key milestones

Infrastructure build is the engine of the company

Build infrastructure in a scaled manner and according to the purpose. Infrastructure is needed for a variety of business processes:

- Manufacturing

- Distribution to Europe

- Warehousing in Europe

- Analytical testing & packaging

- Distribution through wholesalers

- Product to patients

The set-up and maintenance of the infrastructure different business units including finance & tax, commercial, legal & compliance, regulatory & quality, information systems, and supply chain.

About the author

Michelle Lock is Head of Europe/International at Acceleron Pharmaceutical. She held previous leadership positions at Sage Therapeutics and Bristol-Myers Squibb. Michelle was appointed a Greater Zurich Honorary Ambassador in 2018.

This article is a summary of a presentation given at the virtual roundtable “Avoiding pitfalls of U.S. biotech companies coming to Europe” co-hosted on January 27, 2021, by Heidrick & Struggles and Greater Zurich Area Ltd (GZA).

Meet with an expert

Let us connect you with the right person to learn more about how the Greater Zurich Area can support your business needs.

Video

Watch the video and learn why bluebird bio set up shop in Greater Zurich: