Innovation, value creation, sustainability: Annual Report 2023

Innovation, value creation, sustainability: Annual Report 2023

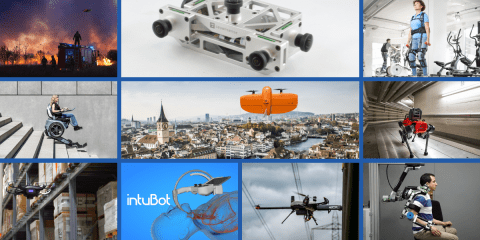

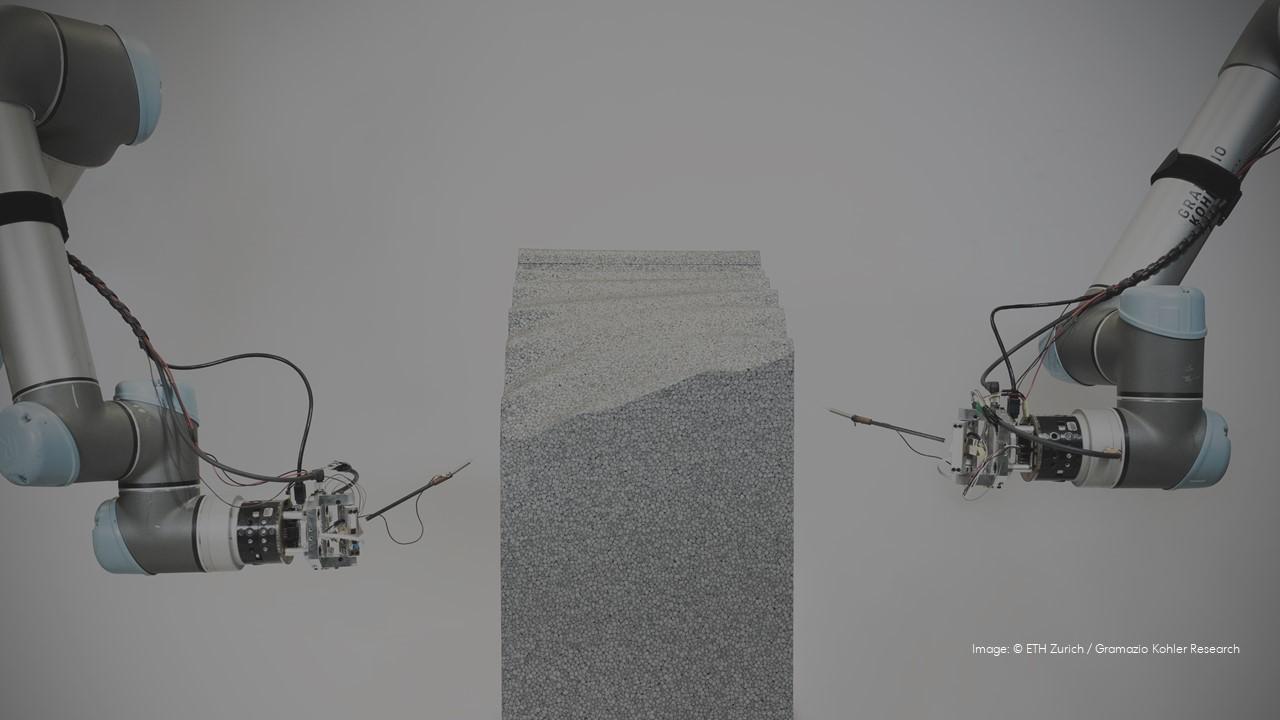

In 2023 the Greater Zurich Area Ltd (GZA) and its partners helped 89 high-quality, pioneering, and promising companies to settle in the Zurich economic region.

Are you looking to grow your business internationally?

Find out why the Greater Zurich Area is the right place to expand your business.

Let us connect you with the right person to learn more about how the Greater Zurich Area Ltd can support your business needs.

Our services are free of charge and include:

- Introductions to key contacts in industry, academia and government

- Advice on regulatory framework, taxes, labor market and setting up a company

- Custom-made fact-finding visits including office and co-working space