The Swiss venture capital market has proven to be untouched by the adversities of the general economic situation for the year 2022. The total volume of investments in technology-based startups amounted to almost 4 billion Swiss francs. This corresponds to a plus of 29.7 percent versus the prior year. The invested venture capital (VC) has almost doubled since 2020 and more than quadrupled since 2017.

These are the results from the most recent Swiss Venture Capital Report. It is published by the online news portal Startupticker.ch and SECA, an investor association based in Zug, in collaboration with the startup.ch platform.

The three largest funding rounds were concluded by Climeworks from Zurich with 600 million, SonarSource from Geneva with 394.6 million, and Wefox, again from Zurich, with 392 million Swiss francs. The total number of financing rounds increased by 7.9 percent in 2022 year on year.

The foreword to the report states that this continued upswing proves that this is not a bubble but is healthy growth, adding that it is “not surprising” that the number of Swiss VC fund projects is also steadily increasing. At the end of 2022, there were 55 VC funds in the fundraising phase.

An above-average increase in investments was recorded by ICT and fintech startups. They accounted for more than 2 billion Swiss francs, thus making up over half of the total sum for 2022. Cleantech stands out as well with 826.9 million Swiss francs, which is four times as much as 2021.

Together, Zurich-based startups drew in more than 50 percent of all Swiss investments. As before, the canton of Vaud is in second place, with 66.8 percent of all of its investments in the medtech sector. There was also clear growth in Geneva and Zug. mm

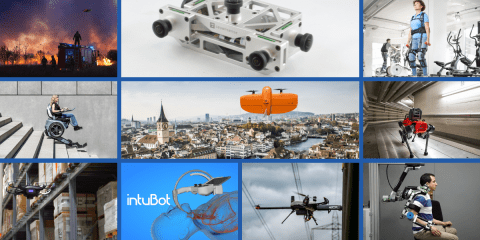

Start-up hub Greater Zurich Area

Start-up hub Greater Zurich Area

Greater Zurich has developed into a very attractive location for successful startups by offering the three most important ingredients for a thriving startup ecosystem: talent, capital and customers. In addition, there are leading universities, renowned companies, mentors, incubators and accelerators, innovation support programs, associations and special events. An innovation and business-friendly environment and a sense of entrepreneurial spirit round off the package.

The PDF outlines why Greater Zurich is a top location for European expansion.

Learn more about the benefits of doing business in the Greater Zurich Area.

The handbook provides information on the key locational advantages Switzerland has to offer.

Contact us

Can we put you in touch with a peer company or research institute? Do you need any information regarding your strategic expansion to Switzerland's technology and business center?

info@greaterzuricharea.com